/ home / newsletters /

Bitcoin Optech Newsletter #129: 2020 Year-in-Review Special

This special edition of the Optech Newsletter summarizes notable developments in Bitcoin during all of 2020. It’s the sequel to our summaries from 2018 and 2019.

As we’ve done in our previous annual summaries, we must prefix what you’re about to read with an apology. Many more people worked on both maintaining and improving Bitcoin’s technology than we could possibly ever write about. Their fundamental research, code review, bug fixes, test writing, administrative work, and other thankless activities may not be described here—but it is not unacknowledged. If you contributed to Bitcoin in 2020, please accept our deepest thanks.

Contents

- January

- February

- March

- April

- May

- June

- July

- August

- September

- October

- November

- December

- Featured summaries

January

Several developers began working on a specification for using Discreet Log Contracts (DLCs) between different software. DLCs are a contract protocol where two or more parties agree to exchange money dependent on the outcome of a certain event as determined by an oracle (or several oracles). After the event happens, the oracle publishes a commitment to the outcome of the event that the winning party can use to claim their funds. The oracle doesn’t need to know the terms of the contract (or even that there is a contract). The contract can be made indistinguishable from many other Bitcoin transactions or it can be executed within an LN channel. This makes DLCs more private and efficient than other known oracle-based contract methods, and it’s arguably more secure as an oracle that commits to a false result generates clear evidence of fraud. By the end of the year, there would be four compatible implementations of DLCs, an application for offering and accepting DLC-based peer-to-peer derivatives, and several users reporting that they’d used DLCs in transactions on mainnet.

February

Five years after the first public presentation about LN, several early protocol decisions meant to be temporary were revisited. The most immediate change was the February update to the LN specification that allowed users to opt out of the maximum channel and payment value limits enacted in 2016.

Another early decision that saw reconsideration was keeping the protocol simple by opening all channels with a single funder. This minimizes protocol complexity but prevents channel funders from receiving any payments until they’ve spent some of their funds—a position that creates barriers to merchants joining LN. One proposal to eliminate this problem is dual-funded channels where both the channel opener and their counterparty commit some amount of funds to the channel. Lisa Neigut has developed a protocol for dual funding, but (as expected) it’s complex. In February, she started a discussion about an incremental improvement over the existing single-funder standard that would allow interactive construction of the funding transaction. Instead of the current case where one party proposes a channel open and the other party either accepts it or rejects it, the nodes belonging to the two parties could exchange information about their preferences and negotiate opening a channel that they would both find desirable.

New progress was also made on the often-discussed plans to allow rendez-vous routing for LN, which was labeled a priority during the 2018 LN specification meeting. A new method for achieving equivalent privacy was described by Bastien Teinturier in February based on a previous privacy enhancement he had proposed. This new method, called blinded paths, was later implemented as an experimental feature in C-Lightning.

March

One method hardware wallets could use to steal bitcoins from their users is by leaking information about the wallet’s private keys via the transaction signatures it creates. In March, Stepan Snigirev, Pieter Wuille, and several others discussed possible solutions to this problem for both Bitcoin’s current ECDSA signature system and the proposed schnorr signature system.

2020 summary

Taproot, tapscript, and schnorr signatures

Nearly every month of 2020 saw some notable development related to the proposed taproot soft fork (BIP341) which also adds support for schnorr signatures (BIP340) and tapscript (BIP342). Together, these improvements will allow users of single-signature scripts, multisignature scripts, and complex contracts to all use identical-appearing commitments that enhance their privacy and the fungibility of all bitcoins. Spenders will enjoy lower fees and the ability to resolve many multisig scripts and complex contracts with the same efficiency, low fees, and large anonymity set as single-sig users. Taproot and schnorr also lay the groundwork for future potential upgrades that may improve efficiency, privacy, and fungibility further, such as signature aggregation, SIGHASH_ANYPREVOUT, and scripting language changes.

This special section concentrates the summaries about those developments into a single narrative that we hope will be easier to follow than describing each event separately in the month it occurred.

January started with a discussion of soft fork activation mechanisms, with Matt Corallo proposing a careful and patient approach to addressing disagreements between different sets of stakeholders. Other developers focused on the BIP8 proposal to be able to quickly bypass the type of procedural problem that delayed segwit activation in 2016 and 2017. The discussion about what precise activation mechanism to use would continue all year, in a dedicated IRC channel and elsewhere, with there being both a developer survey about mechanism design and a survey of miners about their support for taproot.

February saw the first of several updates during the year to the algorithms used to derive public keys and signatures in the BIP340 specification of schnorr signatures. Most of these changes were small optimizations discovered from experience implementing and testing the proposal in libsecp256k1 and its experimental fork libsecp256k1-zkp. Also in February, Lloyd Fournier extended Andrew Poelstra’s previous security proof for taproot.

In March, Bitcoin Core carefully changed its consensus

code—without introducing a fork—to remove an inefficiency in the

parsing of OP_IF and related flow control opcodes. Currently, the

inefficiency can’t be exploited to cause problems, but the extended

capabilities proposed for tapscript would have made it possible for an

attacker to use the inefficiency to create blocks that could take a

large amount of computation to verify.

Although much of the public attention on taproot focuses on its change to Bitcoin’s consensus rules, taproot won’t be a positive contribution unless wallet developers can use it safely. In April, and throughout the year, several updates to BIP340 changed the recommendations for how developers should generate public keys and the signature nonce. The changes are probably only directly interesting to cryptographers, but the history of Bitcoin has many examples of people losing money because a wallet developer didn’t fully understand the cryptographic protocol they implemented. Hopefully, the recommendations from experienced cryptographers in BIP340 will help avoid some of those types of problems in the future.

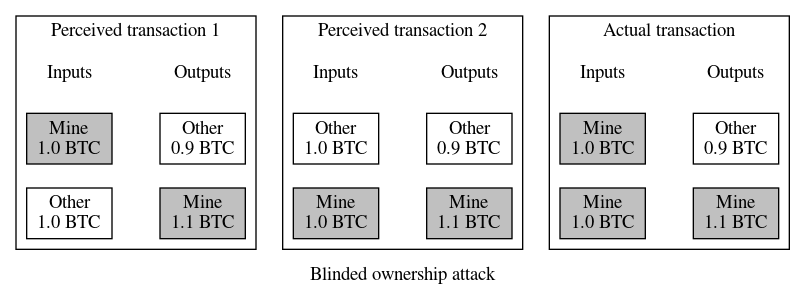

In May, there was renewed discussion about the blinded ownership attack that makes it dangerous to automatically sign transactions with a hardware wallet. Ideally, hardware wallets could provide a mode where they’d automatically sign transactions guaranteed to increase the wallet’s balance, such as maker coinjoins and LN splices. Unfortunately, it’s only safe to sign a transaction if you know for sure which inputs are yours—otherwise an attacker can get you to sign a transaction that looks like it only has one of your inputs, then get you to sign a different version of the same transaction that also looks like it only has one of your inputs (a different input than the first version), and finally combine the signatures for the two different inputs into the actual transaction that pays your money to the attacker. This isn’t normally a risk because most people today only use hardware wallets to sign transactions where they own 100% of the inputs, but for coinjoins, LN splices, and other protocols, it’s expected that other users may partly or fully control some of the inputs. It was proposed that taproot provide an additional way to commit to inputs that can be used in conjunction with data provided in a PSBT to ensure a hardware wallet will only generate a valid signature when it has enough data to identify all of its inputs. This proposal was later accepted into BIP341.

In July, another discussion resumed about a previously known problem—the bech32 address format being less effective than expected at preventing users from sending money to unspendable addresses. This doesn’t practically affect current bech32 address users, but it could be an issue for planned taproot addresses where the addition or removal of a small number of characters could lead to the loss of funds. Last year it was proposed to simply extend the protection current segwit v0 addresses have to segwit v1 (taproot) addresses, but that would reduce the flexibility of future upgrades. This year, after more research and debate, there seemed to be agreement among developers that taproot and future segwit-based script upgrades should use a new address format that’s a slight tweak on the original BIP173 bech32 addresses. The new format will resolve the deficiency and provide some other nice properties.

In September, the code implementing schnorr signature verification and single-party signing functions from BIP340 was merged into libsecp256k1 and soon became part of Bitcoin Core. This allowed the subsequent October merge of the verification code for taproot, schnorr, and tapscript. The code consists of about 700 lines of consensus-related changes (500 excluding comments and whitespace) and 2,100 lines of tests. Over 30 people directly reviewed this PR and related changes, and many others participated in developing and reviewing the underlying research, the BIPs, the related code in libsecp256k1, and other parts of the system. The new soft fork rules are currently only used in signet and Bitcoin Core’s private test mode (“regtest”); they need to be activated before they can be used on Bitcoin’s mainnet.

Many of the contributors to taproot spent the remainder of the year focusing on the 0.21.0 release of Bitcoin Core with the intention that a subsequent minor release, possibly 0.21.1, will contain code that can begin enforcement of taproot’s rules when an appropriate activation signal is received.

April

The payjoin protocol based on the 2018 Pay-to-EndPoint proposal received a major boost in April when a version of it was added to the BTCPay self-hosted payment processing system. Payjoin provides a convenient way for users to increase their privacy and the privacy of other users on the network by creating transactions that undermine the assumption that the same person owns all of the inputs in a transaction. The BTCPay version of payjoin would soon be specified as BIP78 and support for it was added to other programs.

One widely desired improvement to LN is switching the payment security mechanism from Hash Time Locked Contracts (HTLCs) to Point Time Locked Contracts (PTLCs) that improve the privacy of spenders and receivers against a variety of surveillance methods. One complication is that the ideal multiparty PTLC construction is challenging to implement using Bitcoin’s existing ECDSA signature scheme (although it’d be easier with schnorr signatures). Early in the year, Lloyd Fournier circulated a paper analyzing signature adaptors by disentangling their core locking and information exchange properties from their use of multiparty signatures, describing an easy way to use plain Bitcoin Script-based multisig instead. During an April hackathon, several developers produced a rough implementation of this protocol for a fork of the popular libsecp256k1 library. Later, in September, Fournier would further advance the practicality of PTLCs without needing to wait for changes to Bitcoin by proposing a different way to construct LN commitment transactions. In December, he would propose two new ways to improve the robustness of LN backups, again offering practical solutions to user problems through the clever use of cryptography.

April also saw Ethan Kosakovsky post a proposal to the Bitcoin-Dev mailing list for using one BIP32 Hierarchical Deterministic (HD) keychain to create seeds for child HD keychains that can be used in different contexts. This may address the problem that many wallets don’t implement the ability to import extended private keys (xprvs)—they only allow importing either an HD seed or some precursor data that is transformed into the seed (e.g. BIP39 or SLIP39 seed words). The proposal allows a user with multiple wallets to backup all of them using just the super-keychain’s seed. This proposal would later become BIP85 and would be implemented in recent versions of the ColdCard hardware wallet.

Two announcements about vaults were made in April. Vaults are a type of contract known as a covenant that produces a warning when someone is trying to spend the covenant’s funds, giving the covenant’s owner time to block a spend they didn’t authorize. Bryan Bishop announced a prototype vault based on his proposal from last year. Kevin Loaec and Antoine Poinsot announced their own project, Revault, that focuses on using the vault model to store funds shared between multiple users with multisig security. Jeremy Rubin also announced a new high level programming language designed for building stateful smart contracts with the proposed OP_CHECKTEMPLATEVERIFY opcode, which could make it easier to create and manage vaults.

May

The Bitcoin Core project merged several PRs in May and the following months that improved transaction origin privacy, both for users of the Bitcoin Core wallet and for users of other systems. Bitcoin Core #18038 began tracking whether at least one peer had accepted a locally-generated transaction, allowing the wallet to significantly reduce the frequency Bitcoin Core used to rebroadcast its own transactions and making it harder for surveillance nodes to identify which node originated the transaction. PRs #18861 and #19109 were able to block a type of active scanning by surveillance nodes by only replying to requests for a transaction from peers the node told about the transaction, further reducing the ability of third parties to determine which node first broadcast a transaction. PRs #14582 and #19743 allow the wallet to automatically try to eliminate address reuse links when it wouldn’t cost the user any extra fees (or, alternatively, allowing the user to specify the maximum extra they’re willing to spend in order to eliminate such links).

Late May and early June saw two significant developments in coinswaps. Coinswap is a trustless protocol that allows two or more users to create transactions that look like regular payments but which actually swap their coins with each other. This improves the privacy of not just the coinswap users but all Bitcoin users, as anything that looks like a payment could have instead been a coinswap.

-

● Succinct Atomic Swaps (SAS): Ruben Somsen wrote a post and created a video describing a procedure for a trustless exchange of coins using only two transactions. The protocol has several advantages over earlier coinswap designs: it requires less block space, it saves on transaction fees, it only requires consensus-enforced timelocks on one of the chains in a cross-chain swap, and it doesn’t depend on any new security assumptions or Bitcoin consensus changes. If taproot is adopted, swaps can be made even more privately and efficiently.

-

● Coinswap implementation: Chris Belcher posted a design for a full-featured coinswap implementation. His initial post included the history of the coinswap idea, suggested ways the multisig conditions needed for coinswap could be disguised as more common transaction types, proposed using a market for liquidity (like JoinMarket already does), described splitting and routing techniques to reduce privacy losses from amount correlation or spying participants, suggested combining coinswap with payjoin, and discussed some of the backend requirements for the system. Additionally, he compared coinswap to other privacy techniques such as using LN, coinjoin, payjoin, and payswap. The proposal received a significant amount of expert discussion and a number of suggestions were integrated into the protocol. By December, Belcher’s prototype software was creating coinswaps on testnet that demonstrated their strong lack of linkability.

Since Bitcoin’s early days, one of the challenges of developing lightweight clients with SPV security has been finding a way for the client to download transactions affecting its wallet without giving the third party server providing the transactions the ability to track the wallet’s receiving and spending history. An initial attempt at this was BIP37-style bloom filters, but the way wallets used them ended up providing only minimal privacy and created denial of service risks for the full nodes that served them. An anonymous developer posted to the Bitcoin-Dev mailing list in May 2016 suggesting an alternative construction of a single bloom filter per block that all wallets could use. The idea was quickly refined, implemented, and specified, becoming the BIP157 and BIP158 specifications of compact block filters. This can significantly improve the privacy of lightweight clients, although it does increase their bandwidth, CPU, and memory requirements compared to current popular methods. For full nodes, it reduces the DoS risk to that of a simple bandwidth exhaustion attack, which nodes can already address with bandwidth throttling options. Although merged on the server side in btcd in 2018 and proposed for Bitcoin Core around the same time, 2020 saw the P2P part of the protocol merged piecewise into Bitcoin Core in May through August, culminating with the ability for a node operator to opt in to creating and serving compact block filters by enabling just two configuration options.

2020 summary

Major releases of popular infrastructure projects

-

● LND 0.9.0-beta released in January improved the access control list mechanism (“macaroons”), added support for receiving multipath payments, added the ability to send additional data in an encrypted onion message, and allowed requesting channel close outputs pay a specified address (e.g. your hardware wallet).

-

● LND 0.10.0-beta released in May added support for sending multipath payments, allowed funding channels using an external wallet via PSBTs, and began supporting the creation of invoices larger than 0.043 BTC.

-

● Eclair 0.4 released in May added compatibility with the latest version of Bitcoin Core and deprecated the Eclair Node GUI (referring users to instead to Phoenix or Eclair Mobile).

-

● Bitcoin Core 0.20.0 released in June began defaulting to bech32 addresses for RPC users, allowed configuring RPC permissions for different users and applications, and added some basic support for generating PSBTs in the GUI.

-

● C-Lightning 0.9.0 released in August provided an updated

paycommand and an RPC for sending messages over LN. -

● LND 0.11.0-beta released in August allowed accepting large channels.

June

June was an especially active month for the discovery and discussion of vulnerabilities, although many problems were discovered earlier or fully disclosed later. The notable vulnerabilities included:

-

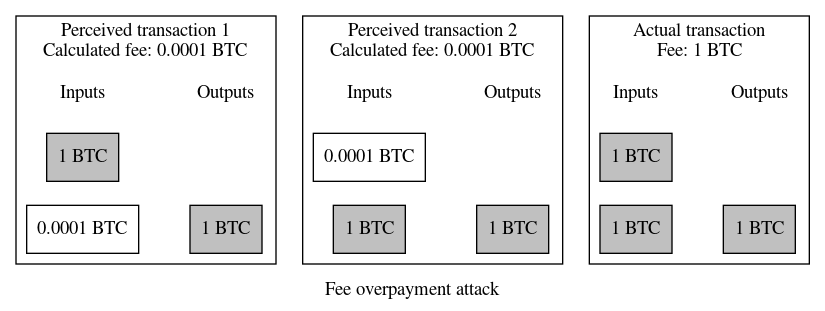

● Overpayment attack on multi-input segwit transactions: in June, Trezor announced Saleem Rashid had discovered a weakness in segwit’s ability to prevent fee overpayment attacks. Fee overpayment attacks are a well known weakness in Bitcoin’s original transaction format where signatures don’t commit to the value of an input, allowing an attacker to trick a dedicated signing device (such as a hardware wallet) into spending more money than expected. Segwit tried to eliminate this issue by having each signature commit to the amount of the input it spent. However, Rashid re-discovered a problem previously discovered and reported by Gregory Sanders in 2017 where a specially constructed transaction with at least two inputs can get around this limitation if the user can be tricked into signing two or more seemingly identical variations of the same transaction. Several developers felt this was a minor issue—if you can get a user to sign twice, you can get them to pay the receiver twice, which also loses their money. Despite that, several hardware wallet manufacturers released new firmware that implemented the same protection for segwit transactions that they’ve successfully used to prevent fee overpayments in legacy transactions. In some cases, such as in the ColdCard wallet, this security improvement was implemented non-disruptively. In other hardware wallets, the implementation broke support with existing workflows, forcing updates to the BIP174 specification of PSBT and software such as Electrum, Bitcoin Core, and HWI.

-

● LN payment atomicity attack: as LN developers worked to implement the anchor outputs protocol to eliminate risks related to rapid rises in transaction feerates, one of the key contributors to that protocol—Matt Corallo—discovered it would enable a new vulnerability. A malicious counterparty could attempt to settle an LN payment (HTLC) using a low feerate and a transaction pinning technique that prevents the transaction or a fee bump of it from being confirmed quickly. The delayed confirmation causes the HTLC’s timeout to expire, allowing the attacker to steal back funds they paid to the honest counterparty. Several solutions were proposed, from changes to the LN protocol, to third-party markets, to soft fork consensus changes, but no solution has yet gained any significant traction.

-

● Fast LN eclipse attacks: although Bitcoin protocol experts from Satoshi Nakamoto to present have been aware that a node isolated from any honest peer can be deceived into accepting unspendable bitcoins, a category of problems sometimes called eclipse attacks, Gleb Naumenko and Antoine Riard published a paper in June showing that eclipse attacks could steal from LN nodes in as little as two hours—although it would take longer to steal from LN nodes that were connected to their own full verification nodes. The authors suggest the implementation of more methods for avoiding eclipse attacks, which did see several positive developments in the Bitcoin Core project this year.

-

● LN fee ransom: René Pickhardt publicly disclosed a vulnerability to the Lightning-Dev mailing list that he had previously privately reported to LN implementation maintainers almost a year earlier. A malicious channel counterparty can initiate up to 483 payments (HTLCs) in an LN channel and then close the channel, producing an onchain transaction whose size is about 2% of an entire block and which needs to have its transaction fee paid by the honest node. Simple mitigations for this attack were implemented in several LN nodes and the use of anchor outputs is also expected to help, but no comprehensive solution has yet been proposed.

-

● Concern about HTLC mining incentives: two papers about out-of-band HTLC bribes were discussed in late June and early July. HTLCs are contracts used to secure LN payments, cross-chain atomic swaps, and several other trustless exchange protocols. They work by giving a receiving user a period of time where they have the exclusive ability to claim a payment by releasing a secret data string; after the time expires, the spending user can take back the payment. The papers examined the risk that the spending user could bribe miners to release the secret data but not confirm the transaction containing it, allowing the timelock to expire so that the spender would get their money back but still learn the secret. Developer ZmnSCPxj reminded the researchers of a well known mechanism that should prevent such problems, a mechanism he helped implement in C-Lightning. Although the idea works in theory, using it will cost users money, so research into better solutions is still encouraged.

-

● Inventory out-of-memory Denial-of-Service attack (InvDoS): an attack originally discovered in 2018 that affected the Bcoin and Bitcoin Core full nodes, which was responsibly disclosed and fixed at that time, was reevaluated in June 2020 and found to also apply to the Btcd full node. An attacker could flood a victim’s node with an excessive number of new transaction announcements (

invmessages), each containing nearly the maximum allowed number of transaction hashes. When too many of these announcements were queued, the victim’s node would run out of memory and crash. After Btcd fixed the problem and users were given time to upgrade, the vulnerability was publicly disclosed.

June also had some good news, with a team of researchers working on the Wasabi coinjoin implementation announcing a protocol named WabiSabi that should allow trustless server-coordinated coinjoins with arbitrary output values. This makes it easier to use coordinated coinjoins to send payments, either between participants in the coinjoin or to non-participants. Wasabi developers worked on implementing the protocol during the remainder of the year.

July

July saw the merge of the BIP339 specification for wtxid transaction announcements. Nodes have historically announced the availability of new unconfirmed transactions for relay using the transaction’s hash-based identifier (txid), but when the proposed segwit code was being reviewed in 2016, Peter Todd discovered that a malicious node could get other nodes on the network to ignore an innocent user’s transaction by invalidating witness data in the transaction that is not part of its txid. A quick fix was implemented at the time, but it had some minor downsides and developers knew that the best solution—despite its complexities—was to announce new transactions using their witness txid (wtxid). Within a month of BIP339 being added to the BIPs repository, wtxid announcements were merged into Bitcoin Core. Although seemingly a minor concern without any obvious effect on users, wtxid announcements simplify the development of hoped-for upgrades, such as package relay.

August

After over a year of development, including multiple feedback-driven changes, the last major revision to the BIP325 specification of signet was merged in early August. Signet is a protocol that allows developers to create public test networks and also the name of the primary public signet. Unlike Bitcoin’s existing public test network (testnet), signet blocks must be signed by a trusted party. This prevents vandalism and other problems that occur because testnet uses Bitcoin’s economic-based consensus convergence mechanism (proof of work) even though testnet coins have no value. The ability to optionally enable signet was finally added to Bitcoin Core in September.

Almost two years after Matt Corallo first proposed the CPFP carve-out mechanism, the LN specification was updated to allow the creation of anchor outputs that use carve outs for security. Anchor outputs allow a multiparty transaction to be fee bumped even if one of the parties attempts to use a transaction pinning attack to prevent fee bumps. The ability to fee bump transactions even under adversarial conditions allows LN nodes to accept offchain transactions without worrying about feerates increasing in the future. If it later becomes necessary to broadcast that offchain transaction, the node can choose an appropriate feerate for it at broadcast time. This simplifies the LN protocol and improves several aspects of its security.

2020 summary

Bitcoin Optech

In Optech’s third year, 10 new member companies joined, we held a taproot workshop in London, published 51 weekly newsletters, added 20 new pages to our topics index, added several new wallets and services to our compatibility index, and published several contributed blog posts about Bitcoin scaling technology.

September

In a 2011 forum post, early Bitcoin contributor Hal Finney described a method by Gallant, Lambert, and Vanstone (GLV) to reduce the number of expensive computations needed to verify Bitcoin transaction signatures. Finney wrote a proof-of-concept implementation, which he claimed sped up signature verification by around 25%. Unfortunately, the algorithm was encumbered by U.S. Patent 7,110,538 and so neither Finney’s implementation nor a later implementation by Pieter Wuille was distributed to users. On September 25th, that patent expired. Within a month, the code was merged into Bitcoin Core. For users with the default settings, the speed improvement will be most apparent during the final part of syncing a new node or when verifying blocks after a node has been offline for a while. Finney died in 2014, but we remain grateful for his two decades of work on making cryptographic technology widely accessible.

Square announced the formation of the Cryptocurrency Open Patent Alliance (COPA) to coordinate the pooling of patents related to cryptocurrency technology. Members allow anyone to use their patents freely and, in exchange, receive the ability to use patents in the pool in defense against patent aggressors. As of this writing, the alliance had 18 members: ARK.io, Bithyve, Blockchain Commons, Blockstack, Blockstream, Carnes Validadas, Cloudeya Ltd., Coinbase, Foundation Devices, Horizontal Systems, Kraken, Mercury Cash, Protocol Labs, Request Network, SatoshiLabs, Square, Transparent Systems, and VerifyChain.

October

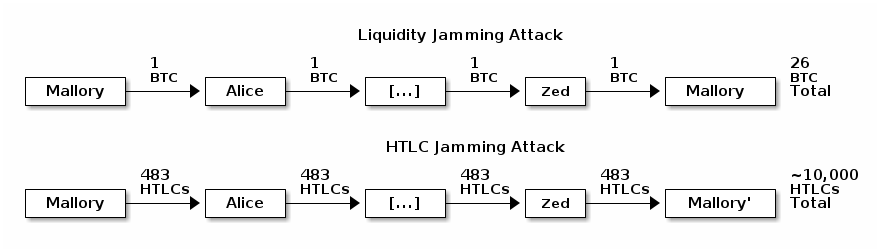

October saw a significant increase in discussion among LN developers about solving the jamming problem first described in 2015, as well as related problems. An LN node can route a payment to itself across a path of 20 or more hops. This allows an attacker with 1 BTC to temporarily lock up 20 BTC or more belonging to other users. After several hours of locking other users’ money, the attacker can cancel the payment and receive a complete refund on their fees, making the attack essentially free. A related problem is an attacker sending 483 small payments through a series of channels, where 483 is the maximum number of pending payments a channel may contain. In this case, an attacker with two channels, each with 483 slots, can jam over 10,000 honest connection slots—again without paying any fees. A variety of possible solutions were discussed, including forward upfront fees paid from the spender to each node along the path, backwards upfront fees paid from each payment hop to the previous hop, a combination of both forward and backwards fees, nested incremental routing, and fidelity bonds. Unfortunately, none of the methods discussed received widespread acceptance and so the problem remains unsolved.

Two money-stealing attacks against LND that were discovered and reported by Antoine Riard in April were fully disclosed in October. In one case, LND could be tricked into accepting invalid data; in the other case, it could be tricked into disclosing secret data. Thanks to Riard’s responsible disclosure and the LND team’s response, we are unaware of any users who lost funds. The LN specification was updated for both problems to help new implementations avoid them.

Over five years after the introduction of the initial segwit proposal, and three years after its activation, there remains no universal way to create and verify plain text messages signed using the keys that correspond to a P2WPKH or P2SH-P2WPKH address. The problem exists more generically as well: there’s no widely supported way to handle messages for P2SH, P2WSH, and P2SH-P2WSH addresses either—nor a forward compatible way that will work for taproot addresses. The BIP322 proposal for a generic signmessage function is an attempt to fix all of these issues, but it’s failed to gain much traction. This year saw an additional request for feedback from its champion, a simplification, and (in October) a nearly complete replacement of its core mechanism. The new mechanism makes message signing potentially compatible with a large amount of existing software and hardware wallets, as well as the PSBT data format, by allowing the signing of virtual transactions that look like real transactions but which can be safely signed because they aren’t valid according to Bitcoin’s consensus rules. Hopefully, this improvement will allow generic signmessage to start to receive adoption.

Jonas Nick, Tim Ruffing, and Yannick Seurin published the MuSig2 paper in October describing a new variant of the MuSig signature scheme with a two round signing protocol and no need for a zero-knowledge proof. What’s more, the first round (nonce exchange) can be done at key setup time with a non-interactive signing variant that could be particularly useful for cold storage and offchain contract protocols such as LN.

Also in October, Bitcoin Core became the first project to

merge an implementation of the version 2 addr

message. The addr message advertises the network

addresses of potential peers, allowing full nodes to discover new peers

without any centralized coordination. The original Bitcoin addr

message was designed to hold 128-bit IPv6 addresses, which also allowed

it to contain encoded IPv4 addresses and version 2 Tor onion addresses.

After almost 15 years in production, the Tor project deprecated version

2 onion services and will stop supporting them in July 2021. Newer

version 3 onion addresses are 256 bits, so they’re not usable with the

original addr messages. The BIP155 upgrade of the addr message

provides more capacity for Tor addresses and also makes it possible to use

other anonymity networks that require larger addresses.

November

As mentioned in the February section, one challenge faced in the current LN network is that users and merchants need channels with incoming capacity in order to receive funds over LN. A fully decentralized solution to that problem could be the dual-funded channels described earlier. However, in November, Lightning Labs took a different track and announced a new Lightning Pool marketplace for buying incoming LN channels. Some existing node operators already provide incoming channels, either for free or as a paid service, but Lightning Pool may be able to use its centrally coordinated marketplace to make this service more standardized and competitive. It’s possible this could also be upgraded to work with dual funded channels when they become available.

December

Last year, Rusty Russell published a first draft of a proposed specification for LN offers, the ability for a spending node to request an invoice from a receiving node over the onion-routed LN network. Although the existing BOLT11 provides an invoice protocol, it doesn’t allow for any protocol-level negotiation between the spender and receiver nodes. Offers would make it possible for the nodes to communicate additional information and automate payment steps that currently require manual intervention or additional tools. For example, offers could allow LN nodes to manage recurring payments or donations by having a spender node request a new invoice each month from a receiver node. In December 2020, the first in a series of commits by Russell to C-Lightning for implementing offers was merged.

Conclusion

One of the things we love about summarizing the past year’s events is that every bit of progress is fully realized. The summary above does not contain promises about what Bitcoin will do in the future—it lists only actual accomplishments achieved in the past 12 months. Bitcoin contributors have a lot to be proud of in 2020. We can’t wait to see what they have in store for us in 2021.

The Optech newsletter will return to its regular Wednesday publication schedule on January 6th.